24.07.2024

France is one of the major investors in Poland

The economic transformation initiated in Poland in the 1990s attracted many foreign investors. French companies very quickly noticed the potential of the developing market by investing in Poland.

Foreign direct investment with French capital has made a strong contribution to the modernization of many sectors of our economy, among them energy, telecommunications and the automotive sector. In 2022, France ranked second, after Germany, in terms of the value of foreign capital invested in Poland.

Some data on the strength of the French economy

France is the sixth largest economy in the world and the third largest in Europe, after Germany and the United Kingdom.

According to World Bank data, France’s GDP was $2.779 trillion in 2022. Forecasts for 2024 predict an increase to $2.799 trillion.

On the other hand, the GDP per capita in France was 40,886.3 USD, and for comparison, in Poland in the same year it was 18,688 USD.

In 2022, France was the eighth largest exporter in the world, with a total export value of $608 billion.

Over the past five years, France’s export value has increased by $83.9 billion.

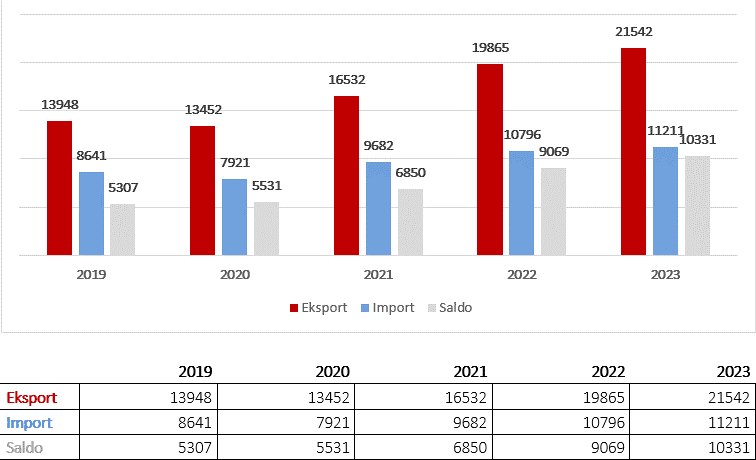

Trade between Poland and France

Since Polish’s accession to the European Union, trade in goods between Poland and France has increased almost fivefold.

France is Poland’s leading trading partner, and Poland has been one of the main suppliers of goods and services to the French market in recent years.

Our exports of goods are growing twice as fast as imports. For several years, Poland has maintained a positive trade balance with France.

Only 20 years ago, at the beginning of Poland’s membership in the EU, we were primarily a recipient of French goods. In 2003, the trade deficit with France amounted to nearly 1.4 billion euros, and imports were almost twice as large as exports.

In 2023, the positive balance amounted to EUR 8.4 billion. A similar trend, although on a smaller scale, applies to trade in the area of services. Although it is six times smaller, Poland has for many years also recorded a positive balance in this category.

French investments in Poland

In fact, there is no sector in Poland in which there is no foreign capital from the country on the Seine. As reported by

the headquarters of the parent company, in our country, the cumulative investments of French companies in 2022 amounted to about PLN 108 billion, while France’s share in total FDI in Poland exceeded 9%, which gave it second place, directly ahead of the Netherlands and the United States.

Since 2017, the value of investments made by French companies in Poland has increased by about a third. During the Covid-19 pandemic, trade relations between Poland and France became even stronger. One of the factors influencing this phenomenon was “nearshoring”, i.e. moving part of a supply chain from Southeast Asia closer to the country on the Seine.

An important aspect of the activity of companies with French capital in Poland is their growing tendency to reinvest their profits. At the beginning of the second decade of the 21st century, the reinvestment rate was around 25%, and in 2019-2022 it increased to almost half of the annual profits of these companies.

Sectors with the highest amount of French capital

Investments with French capital in many sectors stand out from other foreign investors in Poland. They are most active in manufacturing (27%), among which the most important industries are: food, automotive, other transport equipment, pharmaceuticals, electrical equipment and cosmetics.

The next is the services sector (20%), especially information and communication, in which the share in this sector in 2022 was nearly 70%, including the telecommunications, media and IT industries. Business services, especially in the field of administration and support activities, as well as banking and finance, also play a significant role in this sector.

In addition, French capital is intensively active in Poland in the real estate market service industry, mainly in real estate development, and in the transport and logistics sector. The structure of French foreign direct investment (FDI) in Poland is complemented by the construction sector, which accounts for a share of about 3%.

According to the Central Statistical Office, in 2022 there were nearly 1.2 thousand entities with French capital in Poland.

Location of French capital investments in Poland

According to the Central Statistical Office, in 2022 the vast majority (as much as 78%) of French capital was invested in companies registered in the Mazowieckie Voivodeship. Other regions of the country where a significant part of this capital is concentrated are the Wielkopolskie Voivodeship (4% share), Śląskie, Dolnośląskie and Świętokrzyskie Voivodeships (all about 3% share). The remaining 11 voivodeships accounted for less than 10% of the capital of French companies operating in Poland.

Employment thanks to French capital investments in Poland

Since the beginning of Polish’s economic transformation, French capital has played a key role in creating new jobs. Thanks to the investments of French companies, 227,000 direct jobs were created by 2022 and at least as many with local partners. Nearly 2/3 of companies with French capital regularly cooperate with at least 100 Polish partners, buying products from them, ordering services and including them in their global supply chains.

In 2022, France was in third place among the largest employers among companies with foreign capital in Poland.

Areas for further development of economic cooperation between Poland and France

In the coming years, the French-Polish partnership has a chance to develop on many levels – not only business, but also political and cultural. France and its investors appear to be key suppliers of capital and technology in areas of strategic importance for the Polish economy, such as:

- energy transition – France is one of the leaders in the field of renewable energy. In terms of electricity production from renewable sources, it is ranked fourth in the European Union in 2022, and renewable energy accounted for nearly 1/4 of electricity production there;

- defence – France, as a nuclear power, is one of the pillars of European security and is a leading global supplier of military technology. According to SIPRI data, between 2019 and 2023, the country was the second largest arms exporter in the world, with about 11% share of the global market, second only to the US and ahead of Russia;

- digitization and automation – France, in terms of expenditure on research and development (R&D) in the ICT sector, ranks second in the European Union, allocating as much as Italy, Spain and Poland combined;

- improving innovation and developing the country’s infrastructure – France is one of the leaders in innovation in Europe. Industrial companies there allocate nearly 10% of their added value to research and development, which is higher than the average expenditure of manufacturers from Germany or Scandinavian countries, which are considered to be a model in this area.

On the Polish side, there is still a huge potential for domestic companies, those that have not yet started exporting to France and those that are interested in increasing further expansion.

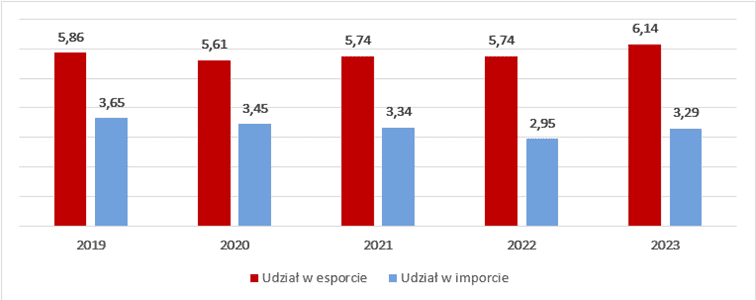

Taking into account French imports of goods from Poland, which in 2023 amounted to only 2.4% (according to French sources, according to the Central Statistical Office, it was 3.29%), while the share of Polish products in German imports in the same year was nearly 7%, Polish companies certainly have a chance to increase their position in exports to the French market in the coming years.

There is great potential especially in sectors that are considered Polish industrial specializations, where Polish companies have significant competitive advantages in Europe. Such sectors include, among others, the production of food, furniture, wood products and finished metal products.

Source:

- The French-Polish Chamber of Commerce, report “The contribution of companies with French capital and Polish-French relations in the development of the national economy”

- National Bank of Poland

- Central Statistical Office

- The Polish Investment and Trade Agency

Spis treściTable of contents

- Everything

- News (260)

- Events (160)

- Get Support (82)

- Polish companies (1009)

-

GRUPA GRAND SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

ConstructionRenovation and construction materialsIndustrial machinery and mechanical appliances and parts thereofShow allShow more Show lessGrupa Grand specializes in designing and manufacturing innovative engineering solutions. The company offers stainless steel swimming pools, vertical parking systems, and services as a general contractor. Its main export products include stainless steel pools and automated parking systems, which are highly regarded in international markets for their high quality, durability, and modern design.

DFM EUROPE SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Show more Show lessDFM is a modern brand on the market of passive fire protection systems like doors, gates and windows. We are a team of professionals manifesting long experience in design and production, technical support and supply of fire resistant doors. DFM DS steel doors have been widely fire tested for miscellaneous fire resistance ratings. Our aim is to secure our Customers’ business with our skills, engagement and expertise as well as products strictly obeying the up – to date fire safety requirements.

ORZESZEK SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Fruit, vegetables, mushrooms and products thereofCereals and products of the milling industryOther food productsShow allShow more Show lessOrzeszek company for more than 20 years we have been selecting, confectioning and selling high-quality foods: nuts, dried fruits, grains, cereals, honey, spices and products from other food categories. As an experienced partner, we assist in the entire process, from product delivery to packaging creation and distribution. We have a network of proven subcontractors and our own logistics facilities. We have been certified by IFS Food, which enables food safety and quality systems.

-

Event

EventAGRO SHOW 2025

International Exhibition – Agro Show 2025 will be held between the 19th-21st September 2025, in Bedn…

Event

EventKIELCE IFRE-EXPO 2025

The 5th International Trade Fair of Fire Brigade and Rescue Services Equipment will be held between …

-

Institution

InstitutionPolish Investment and Trade Agency (PAIH)

The Polish Investment and Trade Agency (PAIH) is the partner of first-resort for entrepreneurs when …

Institution

InstitutionPolish Agency for Enterprise Development (PARP)

Polish Agency for Enterprise Development (PARP) mission is an implementation of economical developme…

-

GRUPA GRAND SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

ConstructionRenovation and construction materialsIndustrial machinery and mechanical appliances and parts thereofShow allShow more Show lessGrupa Grand specializes in designing and manufacturing innovative engineering solutions. The company offers stainless steel swimming pools, vertical parking systems, and services as a general contractor. Its main export products include stainless steel pools and automated parking systems, which are highly regarded in international markets for their high quality, durability, and modern design.

DFM EUROPE SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Show more Show lessDFM is a modern brand on the market of passive fire protection systems like doors, gates and windows. We are a team of professionals manifesting long experience in design and production, technical support and supply of fire resistant doors. DFM DS steel doors have been widely fire tested for miscellaneous fire resistance ratings. Our aim is to secure our Customers’ business with our skills, engagement and expertise as well as products strictly obeying the up – to date fire safety requirements.

ORZESZEK SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Fruit, vegetables, mushrooms and products thereofCereals and products of the milling industryOther food productsShow allShow more Show lessOrzeszek company for more than 20 years we have been selecting, confectioning and selling high-quality foods: nuts, dried fruits, grains, cereals, honey, spices and products from other food categories. As an experienced partner, we assist in the entire process, from product delivery to packaging creation and distribution. We have a network of proven subcontractors and our own logistics facilities. We have been certified by IFS Food, which enables food safety and quality systems.

MOC SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ

Show more Show lessIntriguing trade stands and more! Check out our offers and services NOW! Our products are ecological, aesthetically pleasing, attract customers, are original, handmade and patented and at an attractive price. With us you will sell your products easily!

The Export Promotion Portal uses cookies to make it easier for users to use the website and for statistical purposes. If you do not block these files, you agree to their use and saving in the memory of your computer or other device. Remember that you can change your browser settings to block the storage of cookies. More information can be found in Privacy Policy and Terms and conditions.